- Kreg & Nick - Weekly Mortgage Update

- Posts

- Are Historically High De-Listing a Good Thing?

Are Historically High De-Listing a Good Thing?

The Fed cut rates by 25 basis points this week, marking its third cut of 2025 as Chair Powell highlighted a cooling labor market and stubborn inflation. His more cautious tone signaled growing concern about downside economic risks. With key jobs and inflation data returning this week, markets are finally set to get clarity—and mortgage rates could react quickly.

This cold snap is brutal. The kind of cold that cuts straight through you and makes you question every life choice.

But while the weather is freezing, Central Ohio real estate is heating up.

Mortgage applications are at their highest levels in years, and 2025 is closing out on a strong note with real momentum carrying into 2026. After three long years of grinding through higher rates and tighter conditions, the industry may finally be getting some breathing room.

Agents, lenders, and insurance professionals didn’t just survive this cycle — they endured it. And that resilience might be about to pay off 💪💪

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~5 minutes

Rates ended FLAT compared to last week, and volatility was HIGH. Rates are in the mid-6% range for most loan types without paying discount points. Paying discount points can get you in the high 5’s - low 6's.

Powell Cuts Rates by 25BPS & Easing Begins

On Wednesday, Fed Chair Jerome Powell reduced the federal funds target range by 25BPS amid growing concern about a slowing labor market and persistent inflation pressures. This was the third consecutive rate cut in 2025.

As always, the press conference gives the market guidance on the near-term and long-term gameplan of the Fed. Relative to the October meeting, Powell’s tone was noticeably more cautious leaning towards a willingness pull more levers if inflation remains elevated (higher than the 2% target) and the labor market continues to soften (4.4% unemployment rate).

“Risks to inflation are tilted to the upside and risks to employment to the downside … the balance of risks has shifted,” Powell said, explaining the rationale for the 25-basis-point cut and the broader risk management framework guiding policy.

He didn’t sound particularly confident in any sustained economic rebound.

“We hear loud and clear how people are experiencing really high costs,” he said, framing the rate cut as a response to economic conditions rather than a preemptive move against inflation.

Households ARE struggling. Initial unemployment claims on Thursday landed at 236,000 vs. 192,000 the week before. There is some Thanksgiving seasonality within those numbers, but initial claims were on a 4-week negative trend before last week.

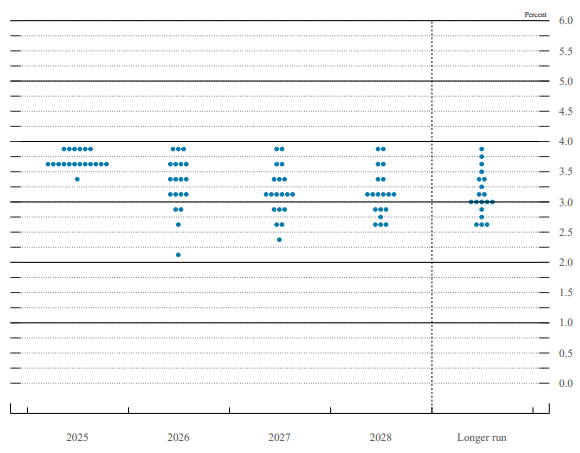

The final dot plot of the year was released on Wednesday, too. While the median only indicates a single 25BPS cut for 2026, it does show quite a bit of dissention between the committee members with one projecting a need for 6 cuts next year.

Powell’s tone matters. And this week, it signaled a c

entral bank that is watching the downside risks more closely than it has in recent months — and is prepared to act if those risks materialize.

All 👀 on Jobs and Inflation: A Pivotal Week for Mortgage Rates

For the past few months, markets have been flying partially blind.

The government shutdown disrupted the release of several key economic reports that typically drive bond markets and, by extension, mortgage rates. Without fresh data, rates drifted aimlessly on uncertainty alone.

That changes this week.

On Tuesday, we finally get the delayed November jobs report, one of the most important inputs for the bond market. Expectations are modest: roughly +50,000 jobs added and an unemployment rate near 4.5%. If hiring comes in weaker than expected, or if unemployment ticks higher, t would reinforce the idea that the labor market is losing steam. That’s the type of data that typically helps mortgage rates improve, as investors price in slower growth and more accommodative Fed policy.

Then comes Thursday’s heavyweight: inflation.

The Consumer Price Index (CPI) is still running about 1% above the Fed’s 2% target, sitting near 3%. But there are reasons to think inflation may cool a bit. Gas prices are visibly lower at the pump, and shelter costs (which make up a large portion of CPI) continue to trend down. While inflation hasn’t been “defeated,” even a modest downside surprise could move markets meaningfully.

So, will Santa deliver lower rates this Christmas 🎅🎁

That answer will be delivered in the data.

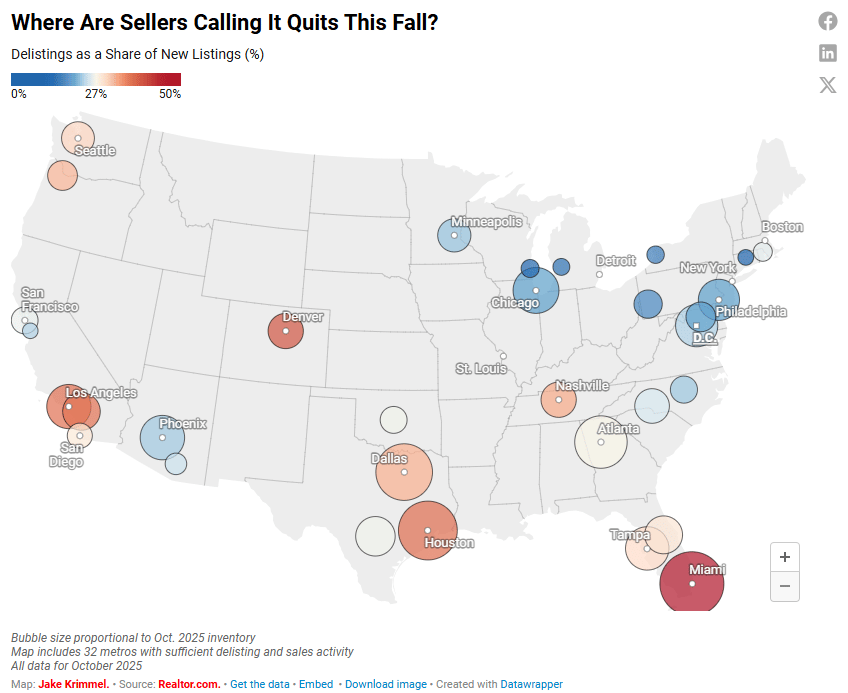

Are Historically High De-Listing a Good Thing?

A new report from Realtor.com shows that de-listings—homes being withdrawn from the market without a sale—are at their highest levels in years. At first glance, that might sound like a red flag. But when you look beneath the surface, this trend is actually a positive signal about the current housing market’s health and stability.

A de-listing happens when a home comes off the market before it finds a buyer. That could be because the seller chose to temporarily pause the listing, relist at a different time or price, or take the home off the market entirely for personal reasons.

Importantly: a de-listing is not the same as a foreclosure or forced sale.

Higher de-listings means more seller confidence.

Sellers aren’t desperate. During a true housing crash, homeowners often rush to sell before prices drop further…which sounds like what Kreg and I experienced during the NFT craze in 2020 🤣 But when sellers choose to de-list, it suggests they aren’t pressed to sell at any cost. They’re comfortable waiting for the right buyer at the right price. That’s a confidence signal, not a panic signal.

Inventory remains in balance. This prevents downward pressure on prices.

Sellers aren’t being forced to dump homes. Buyers aren’t chasing deals out of desperation. The result is a housing landscape that’s healthier and less volatile than headlines might imply.

So next time you hear about de-listings being “at the highest level in years,” remember: that’s not a crisis alert, it’s a confidence indicator.

Rebel 2026 - Give the Gift of Rebel 🎁

This holiday season, we want to encourage you to give a gift that actually lasts. Not stuff. Not gadgets. But growth. Community. Transformation.

The Rebel Experience was created to connect you with other purpose-driven leaders who are leveling-up both personally and professionally. And now, more than ever - we want to invite you to bring someone along for the journey.

🎁 Give the gift of Rebel this Christmas!

✅ VIP Sold Out. ✅ General Admission: 96.5% Sold.

Mark Your Calendars 📅 The big event will be on Thursday February 5th, 2026

Instagram Reels from the Past Week

Two Ways We Can Help

Let’s collaborate – schedule a zoom meeting

Tough deal? Let us help!

Don’t hesitate to reach out if you need anything at all. Have a wonderful week!