- Kreg & Nick - Weekly Mortgage Update

- Posts

- First the 50-Year Mortgage...Now Assumable or Portable Mortgages 🥴

First the 50-Year Mortgage...Now Assumable or Portable Mortgages 🥴

Assumable and portable mortgages sound helpful, but they could actually make affordability worse. NAR is now calling for a big rebound in 2026 with home sales jumping 14%. And after months of delays, this week’s jobs data could shake up the market fast.

It feels like a majority of headlines lately have been mortgage or housing related. I’m not mad about it. Kreg and I created this newsletter to give our audience an unbiased, unfiltered perspective on what each headline boils down to, the ramifications and how agents, lenders and other housing professionals should respond.

Without further ado, let’s dive in 💪💪

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~5 minutes

Rates ended HIGHER compared to last week, and volatility was HIGH. Rates are in the mid-6% range for most loan types without paying discount points. Paying discount points can get you in the high 5’s - low 6's.

First the 50-Year Mortgage…Now Assumable & Portable Mortgages 🥴

I personally got some flack for my Instagram video last week detailing how there may be a small pocket of buyers in America that could take advantage of a 50-year mortgage to increase their net worth. Even Ms. Stars and Stripes herself, Glennda Baker, mixed it up with me in the comments. I’m not sure I’ve seen a more polarizing mortgage topic in my career.

While the 50-year mortgage was publicly shamed, it didn’t stop Bill Pulte (head of the Federal Housing Finance Agency) to throw out a few more ideas to tackle affordability : making assumable and portable mortgages widely available.

Would these actually improve affordability? Let’s define them first.

An assumable mortgage lets a buyer take over the seller’s existing home loan. They get the same interest rate, same remaining balance, same terms. If the seller has a 2.75% rate, the buyer gets that 2.75% rate too.

A portable mortgage lets a homeowner take their current loan with them to a new home. Think of it like unplugging your mortgage from one house and plugging it into another. The same rate and same loan structure follow to the next home.

1️⃣ Low Rates Inflate Prices (Assumables)

Homes with ultra-low assumable rates become “rate-boosted.” Buyers pay more for the rate, not the house which drives prices even higher. Affordability gets worse, not better.

2️⃣ The Equity Gap (Assumables)

Even if a buyer assumes the low rate, they can’t assume the seller’s equity.

If the seller owes $300K but the home is worth $450K, the buyer needs another $150K through cash or a second loan. Most buyers can’t bridge that gap. So the low-rate loan doesn’t magically make the home affordable.

3️⃣ Portability Doesn’t Lower Prices (Portables)

A portable mortgage only helps the existing homeowner keep their low rate. It doesn’t make homes cheaper. It doesn’t help first-time buyers. It reinforces a “haves vs. have-nots” market based on who locked in a good rate years ago.

4️⃣ Doesn’t Increase Inventory (Both)

Affordable housing improves when there’s more supply. Assumables and portables don’t create new inventory, they just reshuffle who gets access to old low-rate loans.

5️⃣ They Don’t Change High Home Prices (Both)

Rates are only one piece of affordability. If home prices are high, taxes are high, and insurance is high, a low-rate mortgage—assumed or portable—can only do so much.

Besides the affordability concerns, banks and servicers will lobby hard against these ideas. They don’t want the low rate loans on their books. Additionally, the man power involved to move the loans (to a new borrower or to a new property) is too much of a logistical burden without much monetary gain.

Key Takeaway: Affordability is the most important factor affecting the US housing market, but many of the mortgage ideas floating around could have massive unintended consequences resulting in less affordability. 50-year mortgages, assumable loans, portable loans, etc. will increase demand in the long-run. Any action that increases demand without a meaningful increase in supply will make the situation worse.

2026 Housing Market Expected to be +14%

Early in the year, Kreg and I like to make bold predictions and one of our boldest was calling 2025 the bottom of this housing cycle. A blind squirrel finds a nut every now and then, but we may have nailed that call.

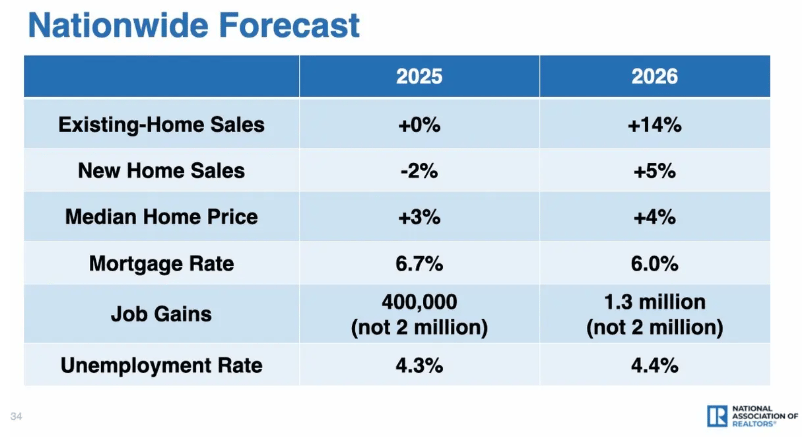

According to the latest forecast from the National Association of Realtors (NAR), 2026 could be the year the housing market finally shifts gears.

Chief economist Lawrence Yun laid out the numbers in a recent NAR release and said sales could rise around 14% nationwide in 2026, after flat numbers in 2025. He is forecasting a 4% gain in home prices, too.

Why the optimism?

A few key pieces are falling into place: mortgage applications are holding up, jobs remain solid (unless that story changes when the overdue jobs reports release later this month) and builders are starting to inch supply back up. Interest rates won’t tumble to the 3% days of old, they’re forecast to drift a bit lower (Yun expects roughly a 6% 30-year fixed average next year, down from the ~6.7% level this year).

Key Takeaway: The head economist at NAR expects home sales to shoot up 14% next year 🙌 Start laying your foundation for 2026 now. Sowing those seeds now will ensure you get a piece of that larger pie.

Government is Open…Let’s See That Jobs Data!

We’ve been waiting a long time for Labor Department’s September and October hiring and unemployment figures due to the federal government shutdown…

This Thursday (11/20), we will finally be able to sink our teeth into the September data in addition to the unemployment claims data, which hasn’t been released since mid-September.

Markets could be in for a bumpy week through the release of those figures. They’ve been starved for data for almost 2 months.

Forecasts haven’t been announced yet, but the August data showed a meager 22,000 jobs added with an unemployment rate of 4.3%.

What about the October data? During the shutdown, the Labor Department claims it was able to get enough from the business survey to calculate how many jobs were added/lost. However, they were not able to conduct their household survey, which feeds the unemployment rate. Now that the government is back online, hopefully there is enough time to get an updated view of unemployment for November.

Rebel 2026 - Speakers Revealed & Tickets On Sale

| Rebel is a one-day event where professional real estate agents, marketers, and entrepreneurs come together to burn the old playbook and build something better. Raw. Loud. Unlike anything this industry has seen. Mark Your Calendars 📅 The big event will be on Thursday February 5th, 2026 |

Instagram Reels from the Past Week

Two Ways We Can Help

Let’s collaborate – schedule a zoom meeting

Tough deal? Let us help!

Don’t hesitate to reach out if you need anything at all. Have a wonderful week!