- Kreg & Nick - Weekly Mortgage Update

- Posts

- Is Inflation Actually at 1.2%?

Is Inflation Actually at 1.2%?

Inflation data is sending mixed signals, the Fed is standing pat on rates, and a controversial new tax idea for homeowners is gaining traction on X. At the same time, quiet moves inside Fannie and Freddie — plus a surprise front-runner for the next Fed Chair — could reshape mortgage rates in 2026.

Do y’all remember as a kid when you heard school was cancelled due to snow? I have to believe that moment was peak joy.

What’s second in terms of peak joy? Seeing a new weekly update from Nick & Kreg, if I had to guess 💪💪

Rebel 2026 is in 10 days on February 5th at Kemba Live! Make sure you get tickets, you won’t want to miss this.

Let’s dive in!

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~5 minutes

Rates ended HIGHER compared to last week, and volatility was HIGH. Rates are in the low-6% range for most loan types without paying discount points. Paying discount points can get you in the high 5’s.

Is Inflation Actually at 1.2%?

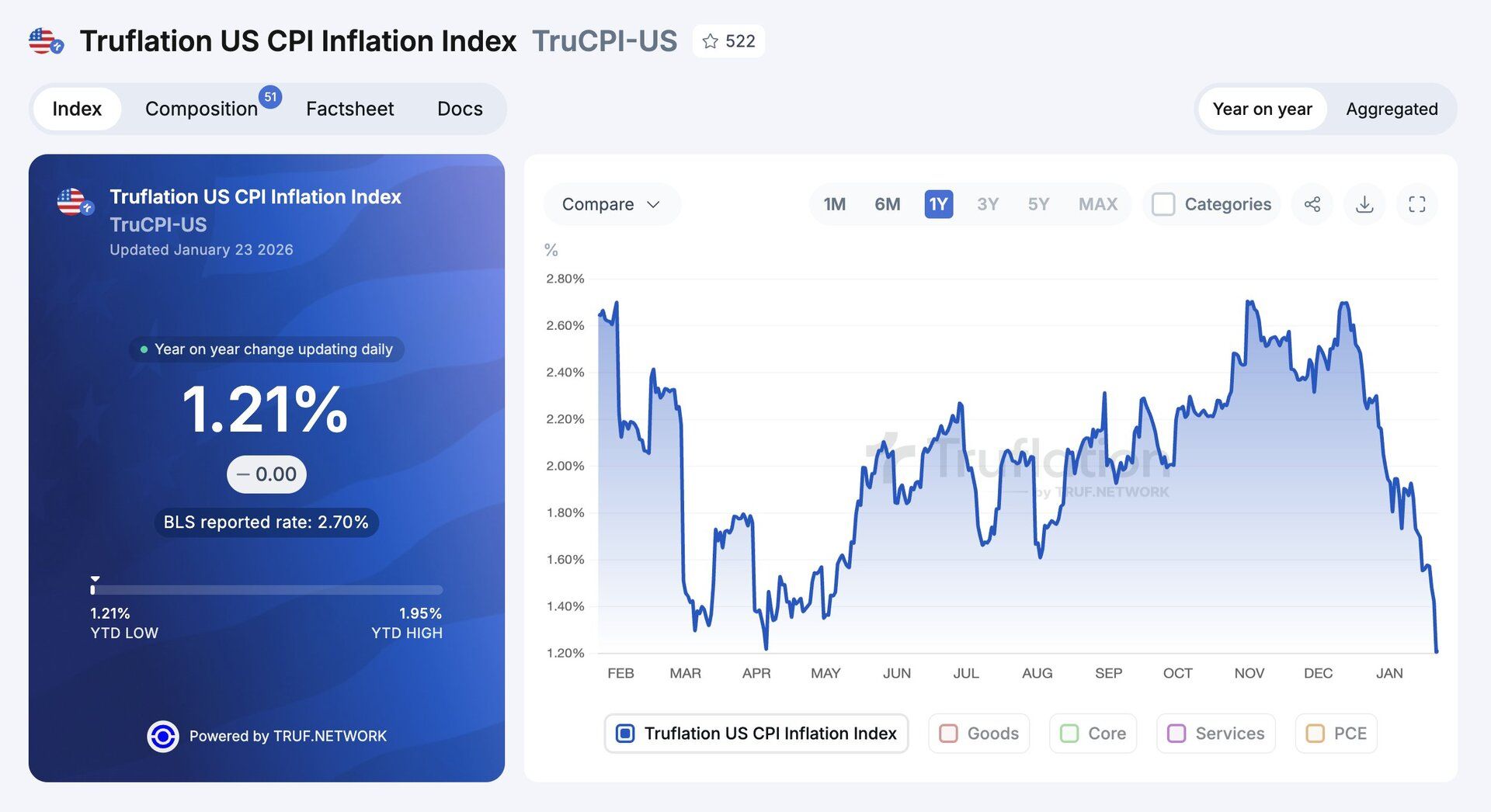

When we talk about inflation, Kreg and I always point to CPI (Consumer Price Index). That’s the official number the Federal Reserve, lenders, and markets reference. It’s based on monthly surveys of prices for a fixed basket of goods and services, and it’s designed to give policymakers a stable, consistent picture of inflation over time. The Fed’s long-term target is about 2 percent inflation per year, a level they believe balances price stability with healthy economic growth.

Truflation, on the other hand, is a newer, private, real-time inflation tracker that scrapes millions of actual price points from online sources every day instead of waiting on monthly surveys. Because of that, its numbers tend to move faster and sometimes tell a different story than the official CPI.

CPI is a history book whereas Truflation is like a live news feed.

Right now, recent Truflation data shows inflation around 1.2 percent year-over-year, which is well below the Fed’s 2 percent target and noticeably lower than the most recent official CPI figures.

That gap suggests prices in some parts of the economy might be cooling faster than what the government’s lagged data is showing. This has sparked debate among economists and investors about whether inflation is really easing quicker than expected, and whether the Fed should reconsider keeping interest rates as high as they are. Some analysts even worry that if prices continue to slow this sharply, the risk of deflation—not just low inflation—could become real.

Based on Truflation metrics, the Fed is winning against inflation. But with a 98% probability of NOT cutting rates this week at the first Fed meeting of 2026, the Fed does risk slowing the economy too much due to fewer jobs, weaker housing and higher recession risk.

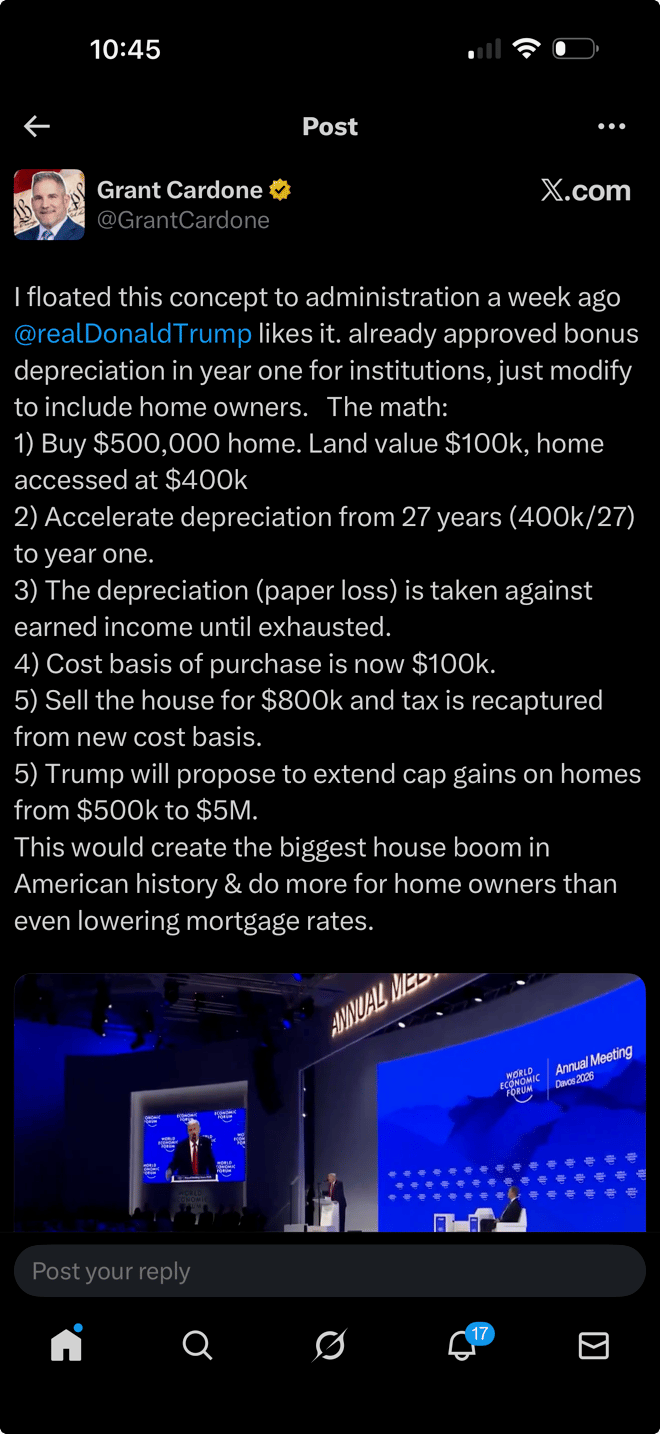

Is Cardone’s Affordability Plan Plausible?

On X this past week, Grant Cardone proposed a plan to approve bonus depreciation for owner-occupied properties instead of keeping that strictly for investors.

When an investor at his level speaks, folks certainly listen. From an economic perspective, is this a good idea?

Let me break down the idea first.

Grant Cardone’s idea is that people who buy a home should be allowed to get a big tax break, similar to what real estate investors get. Cardone wants owner-occupied homeowners to be able to write off most of their home’s value right away, in the first year they own it. This would mean they pay much less in taxes at the beginning, keeping more of their money. The trade-off is that later, when they sell the house, it would look like they made a much bigger profit on paper, so they would likely owe more taxes at that time. The expectation is that the tax code would be more favorable to sellers in the future allowing for much larger capital gains exemptions than we have today.

You buy a house > You get a huge tax write-off > the government takes less money from your income. The buyer feels like they have more usable income to handle a bigger mortgage payment, qualify for more house and feel safer stretching the budget.

WHY THIS SOUNDS AMAZING (PROS)

1. Would massively boost buying power: People could offset income with depreciation → lower tax bills → more cash flow → qualify easier.

2. Would pull demand forward FAST: High earners would rush to buy homes for tax benefits alone.

3. Would juice move-up buyers: Homeowners sitting on equity would have a new tax incentive to upgrade.

4. Realtors/lenders would be slammed (in a good way): Listings + buyers + investor-style math = transaction volume spike.

5. Construction would surge: Builders would love this. New supply would ramp hard.

THE PROBLEMS I SEE (CONS)

1. It would explode home prices: Affordability would likely get even worse. Prices would jump faster than rates ever could help. First-time buyers would get crushed.

2. It heavily favors high-income buyers: Depreciation only helps if you make a lot of money and/or pay a lot in taxes. Most normal buyers wouldn’t benefit much.

3. IRS complexity nightmare: This type of policy would complicate tax returns and confuse 90%+ of consumers.

4. Politically, it just wouldn’t work: It would cost the government hundreds of billions and be framed as “tax breaks for rich homeowners”.

5. To assume capital gains exemptions in the future is super risky: That alone would blow a crater in federal tax revenue.

I genuinely love all the ideas being thrown around on X lately. Some are good, most are bad. It does feel like affordability is front and center on everybody’s mind. I’m praying we find a win-win solution that can truly help those that most need it…first time homebuyers.

Two Headlines May Dramatically Affect Rates in 2026

Lately the news has been coming through in droves in early 2026. Let’s quickly review a few top headlines from the last few days that could really impact rates this year.

The first was from The Associated Press that intercepted a note from the Federal Housing Finance Agency (FHFA) written to top officials at Fannie Mae and Freddie Mac eliminating the caps prohibiting both lenders from holding more than $40 billion in mortgage bonds. It set a new amount at $225 billion each. That’s over $170 billion OVER what the president had instructed just a few weeks ago.

Bill Pulte, head of the FHFA, insists that the entities will not exceed the president’s mandate.

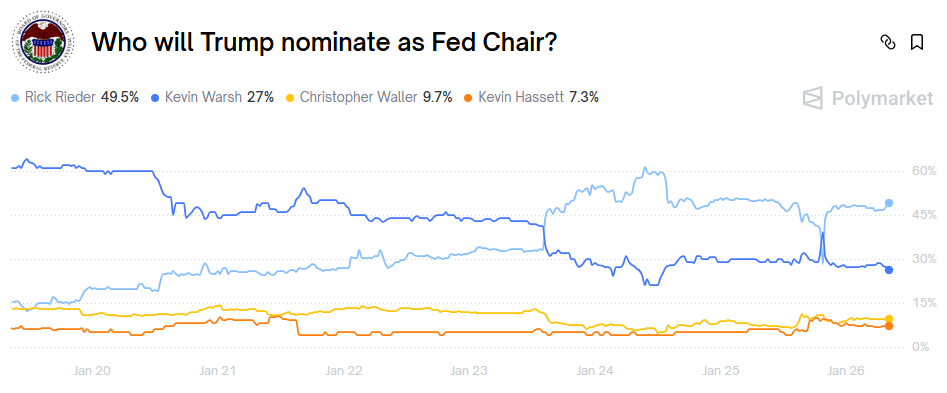

Additionally, the candidate for the next Federal Reserve chair took a major turn. It was down to the “Two Kevins” for a while. But within the last week, Rick Rieder of Blackrock fame, has pulled ahead to almost 50% odds on Polymarket (up from 3%).

With Jerome Powell’s term ending in May of 2026, the next chair is expected to be one who favors lower interest rates.

Known for his deep knowledge of the bond market, little is known about Rick’s potential gameplan to bring down rates. But he is on record stating the federal funds rate should be about 0.5 to 0.75% lower than where it is today, which would certainly impact longer-term mortgage rates.

Rebel 2026 - What Are You Waiting For?

Most agents don’t get stuck because they make bad decisions.

They get stuck because they keep waiting to make any decision.

Waiting for the market to change.

Waiting for your schedule to calm down.

Waiting to feel more “ready.”

Is that really the plan?

Rebel isn’t about motivation. It’s about changing how your business actually runs - your brand, your strategy, your leverage, your mindset.

There will never be a perfect time.

There is only the time you decide.

So what are you waiting for?

Mark Your Calendars 📅 The big event will be on Thursday February 5th, 2026

Instagram Reels from the Week

Two Ways We Can Help

Let’s collaborate – schedule a zoom meeting

Tough deal? Let us help!

Don’t hesitate to reach out if you need anything at all. Have a wonderful week!