- Kreg & Nick - Weekly Mortgage Update

- Posts

- Let’s Look BACK on Our 2025 Projections

Let’s Look BACK on Our 2025 Projections

“It was the best of times, it was the worst of times” might be the most accurate way to describe the housing market we just lived through. In this issue, we break down what actually happened in 2025, how eerily accurate our forecasts were, and the signals smart buyers and homeowners should be watching as we head into 2026.

Before we dive in…THANK YOU. Your time is valuable, and the fact that you choose to spend a few minutes each week reading this newsletter doesn’t go unnoticed. There are endless options in your inbox, and we’re honored you continue to choose this one.

Cheers to an amazing 2025 🍻

We can’t wait to continue to serve our community in 2026 💪

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~5 minutes

Rates ended DOWN compared to last week, and volatility was LOW. Rates are in the low-6% range for most loan types without paying discount points. Paying discount points can get you in the high 5’s.

Let’s Look BACK on Our 2025 Projections

“It was the best of times, it was the worst of times.”

Here we are, just a few days before the end of another year. Honestly, I feel like just last week I was reminiscing about 2024. 2025 didn’t disappoint. Just like the start of a Tale of Two Cities from Charles Dickens, it was a great year but in certain ways it was definitely tough for many. We lived through 3 long years of rates perpetually feeling like they were stuck near 7%. Affordability was getting squeezed. Buyers were getting cold feet.

As y’all know, Kreg and I have become psuedo-economists (🤣🤣). So last year, we took our first shot at projecting what we expected 2025 would look like. In summary, Barry Habib better watch out. The next crystal ball award might be given to us.

How Did We Do?

2025 Projection - Transaction volume will be flat. As of November 2025 data, the seasonally adjusted existing home sales data shows a 1% decline. We should end the year around that 4.1 million mark. Nailed it ✅

2025 Projection - Mortgage Rates will range between 6.5% and 7.125%. For most of 2025, interest rates ranged exactly between 7.125% and 6.5%. In September, once the Fed started their rate cutting cycle, we saw rates drop below that 6.5% mark and fortunately they’ve stayed below that mark for the remainder of 2025. All things considered, I’d say the projection was solid. That said, I’ll gladly take rates coming in even lower than expected.

2025 Projection - New home sales has peaked. Shockingly, the data for this is really old. Currently we have data on new home sales through August of 2025. The July data showed a decline in new home sales year-over-year but then August saw a massive jump of +20%, which pushed new home sales positive year-over-year. I’ll say we wait until 2025 actualizes before we give marks on this one ⏸️

2025 Projection - 2025 will be a buyer’s market. Sellers lost their dominance in 2025. We saw FAR fewer bidding wars, less inspection waivers and the market started to heal. FHA deals were getting accepted and we saw a resurgence in seller credits. Active inventory rose 16.4% and 39% of listings saw price cuts. Affordability definitely improved for buyers last year. Nailed it ✅

Kreg and I will be dusting off our crystal ball soon. We will roll out our projections for 2026 in early January. Obviously you’ll want to pay close attention.

As we close 2025 and welcome 2026, I finally feel a pretty strong tailwind at the industry’s back! Rates are trending lower (and staying lower) and affordability is improving.

If you managed to weather the last few years, buckle up because you’re about to harvest what you’ve sown.

Car Repos Projected to be Highest Since 2009

A saw a post in Facebook from Robert Kiyosaki (author of Rich Dad Poor Dad) discussing the increase in car repos in 2025 so I thought I’d dig in. What I found was that Robert was right but the data wasn’t AS profound as he claims.

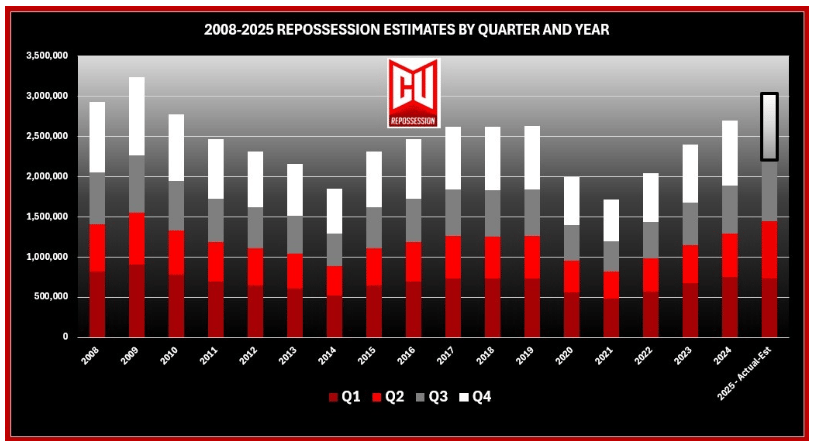

Here is the chart that he posted. In my past life, I was a data analyst at Bath & Body Works headquarters. I’m always hesitant to trust any chart, especially one without a source noted.

That swing is violent and definitely deserves attention. After digging in, I found that this chart is using Cox Automotive data, which traditionally looks at car auction data to track repos. Their data does not track why a vehicle was sold at auction. It could have been a repo, but the car may have been simply returned and/or off-lease.

Repo data is REALLY hard to track. Credit bureaus, banks, credit unions, captive finance arms (like GM Financial, Toyota Financial), subprime auto lenders, tow truck drivers and repo management firms would all need to provide data to accurately track repos.

The most trusted source (RPN) is the most trusted data source in the repo industry, though admittedly it is still flawed. But the picture remains the same. Repos in 2025 will be at the highest level since 2009.

Higher repo numbers are widely regarded as a canary in the coal mine since they can indicate concerns with household credit, employment stability and discretionary income.

Typically, financial stress emerges in a sequence that mirrors this pattern:

Credit cards → Auto loans → Rent/Mortgage

Historically, auto delinquencies rise 12-24 months before housing stress.

This does not mean we are on the cusp of a 2008 housing crisis. Since the Great Financial Crisis, mortgage lending standards are materially tighter which have required stronger buyer profiles, higher credit quality, fixed rates and full income documentation underwriting.

Car repos are still something to watch. As Robert mentioned correctly in his post “auto repossessions aren’t the crisis. They’re the signal. The signal that debt has finally outrun income.”

Rebel 2026 - Big Announcement Coming Soon

I’ll keep this brief. Another big announcement about the Rebel event will drop early January. You’ll want to be at this event. Just grab your tickets now.

Mark Your Calendars 📅 The big event will be on Thursday February 5th, 2026

Two Ways We Can Help

Let’s collaborate – schedule a zoom meeting

Tough deal? Let us help!

Don’t hesitate to reach out if you need anything at all. Have a wonderful week!