- Kreg & Nick - Weekly Mortgage Update

- Posts

- Mortgage Rates See Their Strongest Move Lower in Three Years

Mortgage Rates See Their Strongest Move Lower in Three Years

Mortgage rates just made their strongest move lower in years after a surprise $200B government intervention late Thursday night. At the same time, the latest jobs data looks better on the surface — but much weaker underneath. And quietly, rents are now falling nationwide, setting up a major shift in the inflation and rate outlook ahead.

Typically I wait until Sunday to start putting pen to paper for the weekly newsletter. However, I have an early Monday commitment so I wanted to get a bulk of the newsletter knocked out mid-week.

Then Thursday and Friday happened.

The news from those two days made everything I had prepared obsolete.

So… back to the drawing board.

AND be sure to check the BIG Rebel announcement below 🔥📢

Just like that, 2026 is coming in like a lion. Let’s dive in. 🦁💪

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~5 minutes

Rates ended DOWN compared to last week, and volatility was HIGH. Rates are in the low-6% range for most loan types without paying discount points. Paying discount points can get you in the high 5’s.

Mortgage Rates See Their Strongest Move Lower in Three Years

Late Thursday night, President Trump announced he’s directing Fannie and Freddie to buy $200B in mortgage-backed securities.

That move pushed average mortgage rates nationwide below 6% — a level we haven’t seen in over three years.

We’ve gotten close a few times recently, but every time rates flirted with the low 6s, they bounced right back into the 7s.

This announcement likely changes that. It helps hold rates around these levels and likely keeps them from drifting higher — unless we get some unexpectedly strong economic news, like a big upside surprise in jobs data.

Mortgage spreads were already improving before the announcement, too.

Quick refresher: the “spread” is just the extra return investors demand on mortgages compared to ultra-safe U.S. Treasuries. So if the 10-year Treasury is at 4.0% and mortgage rates are 6.0%, the spread is 2.0%.

Historically, that spread is closer to 1.6%–1.8%, and after years of being inflated, we’re basically back in that normal range now.

Obviously this is huge for the housing industry in the short-term. It’s hard to deny that lower rates will help push up mortgage transactions in 2026. However, there are always some potential risks long-term with moves like this.

Government buying at this scale can distort the market a bit. It pushes mortgage prices higher (resulting in lower rates) than they might naturally be, which means private investors step back and the market becomes more dependent on government support.

There’s also the inflation risk. Pumping $200B into mortgage bonds loosens financial conditions, which can heat things up again if the economy is already strong.

And finally, whenever this buying eventually slows or stops, rates could become more volatile. If a big buyer leaves the market, prices can fall quickly — and rates can jump just as fast. A great example was when the Fed announced a slowing of their purchases of MBS in November of 2021 and then a full-stop in March of 2022. We all know what happened next…

December Job Data Shows Mixed Messages

For the first time in a few months we got a timely release of the jobs data covering December 2025. It was definitely a mixed bag, but when you peel back the layers, it feels far worse.

The non-farm payroll numbers added 50,000 jobs in December, which was slightly below estimates around 66,000. Additionally, the unemployment rate dropped from 4.6% to 4.4%.

As usual, October and November numbers were revised negatively. November LOST an additional 8,000 jobs for a new total of +56,000. October LOST an additional 68,000 jobs for a new total of -173,000. October 2025 is now the weakest monthly reading since December 2020. In all of 2025, we lost 624,000 from the initial release to the second revision. According to the Kobeissi Letter on X, each job’s report from 2025 was revised down an average of 56,728 jobs. Apply that to December and we may be closer to another negative reading after the next two revisions.

What surprised me was the 0.2% DROP in unemployment.

Unemployment Rate = Unemployed People Looking for Work / Labor Force

The “labor force” is the sum of the employed + unemployed actively looking for work. If a big chunk of the population decides to stop looking for work, they are pulled from the “unemployed people” and the “labor force” resulting in a lower (better) unemployment rate (assuming nobody was hired and no one got laid off).

Markets early Friday absorbed the jobs data and the stronger unemployment rate seemed to soften the massive rate improvements from the President’s $200B bond push Thursday night. Had the jobs report shown a steady or worse unemployment rate, I think mortgage rates would have improved even further.

Rents Down TODAY Should Help Inflation TOMORROW

Apartment List National Rent Report covering December 2025 shows rent prices on new apartments nationally are down 1.3% compared to a year ago. The vacancy rate on new apartments is at an all-time high of 7.3%. It takes, on average, about 39 days to lease a new apartment (also all-time high) vs. 36 days a year ago.

A wave of new apartments along paired with sluggish demand are the culprits.

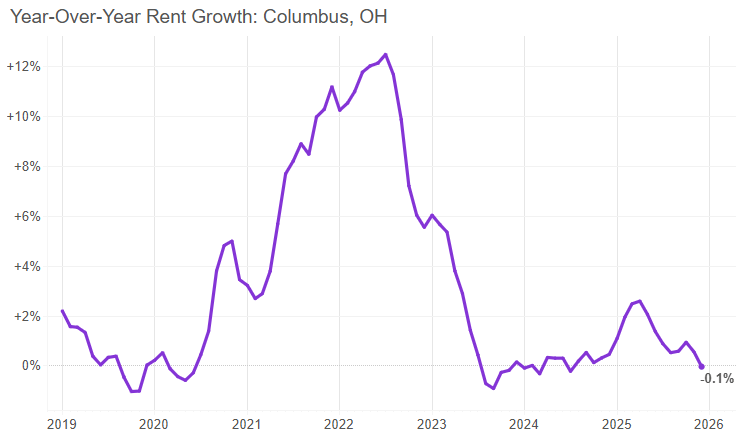

Here locally in central Ohio, year-over-year rent growth is -0.1% or basically flat.

This dataset does not include lease renewals, but we’ve heard anecdotally that those, too, are coming down.

When it comes to inflation, rent and rent-like housing costs make up about 33% of headline CPI and 44% of core CPI (less food & energy). As you can see, this heavily influences those topline inflation numbers. If prices fall, it directly helps slow down inflation numbers.

Falling rent shows the economy is cooling down in a healthy way. Inventory is normalizing and things aren’t overheating as they were in 2022/2023.

Only a fraction of rents update on any given month. Market rent, like the data tracked by Apartment List, can rise and fall rapidly. But the CPI rent calculation averages millions of existing leases, may of which were signed months ago.

The effects of falling rent will continue to take time to pull down inflation, but it should hold inflation down for a while. Lower inflation, as y’all know, is one less variable to potentially spike mortgage rates.

Rebel 2026 - Jared James Joins Rebel

Jared James is one of the most respected and trusted voices in real estate — known for cutting through noise, calling the market exactly how it is, and helping professionals adapt before they fall behind.

On the Rebel stage, Jared will deliver a powerful session titled: “How To Win In The New Era Of Real Estate.”

In this session, you’ll learn how to:

Understand where the industry actually is — and why this market is different from anything we’ve seen before

Make the necessary pivots to meet today’s consumer expectations instead of fighting them

Create a real game plan to gain local market share, using today’s strategies for business creation and growth

Mark Your Calendars 📅 The big event will be on Thursday February 5th, 2026

Two Ways We Can Help

Let’s collaborate – schedule a zoom meeting

Tough deal? Let us help!

Don’t hesitate to reach out if you need anything at all. Have a wonderful week!