- Kreg & Nick - Weekly Mortgage Update

- Posts

- Mortgage Rates Dropping — A Blessing & a Curse!

Mortgage Rates Dropping — A Blessing & a Curse!

The Fed is set to cut rates again, but because the market already expects it, mortgage rates may not drop much—and buyers could keep waiting. At the same time, crypto is moving into mainstream finance, and JPMorgan’s plan to accept Bitcoin and Ethereum as collateral could reshape real estate. Now, a Trump-backed proposal to push rates even lower through Fannie and Freddie brings short-term relief, but with big long-term risks for the housing market.

🎃 It’s Halloween Week 🎃

If you’re out and about, you might just spot Katie and me cruising around on our magic carpet as Aladdin and Jasmine! While we will be flying up in the clouds, the market is serving up some scary surprises — a Fed rate cut, JPMorgan diving into crypto lending, and a new plan that could push mortgage rates closer to 5%!

Let's dive into the spooky deets!!

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~5 minutes

Rates ended FLAT compared to last week, and volatility was MODERATE. Rates remain in the low 6% range for most loan types without paying discount points. Paying discount points can get you in the high 5's.

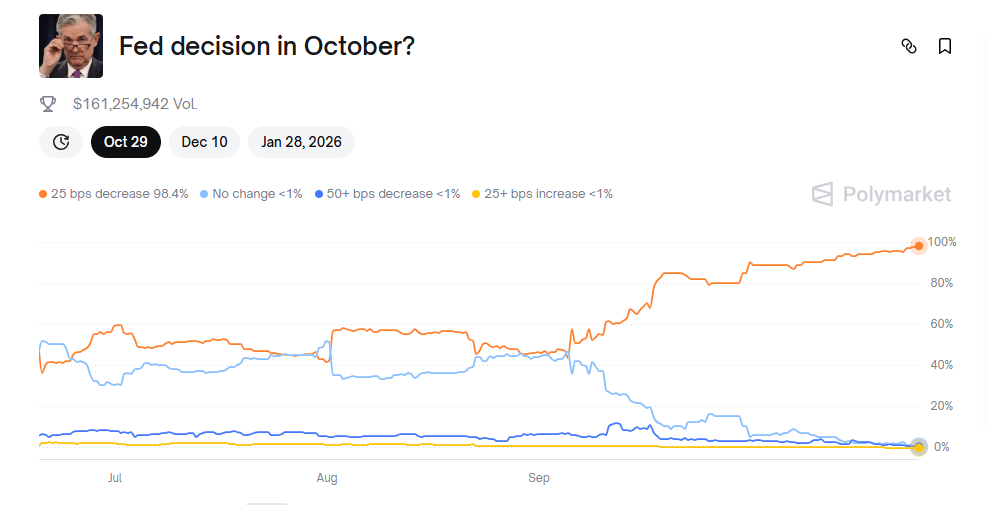

Fed Rate Cut Coming!

It’s our favorite time of the month — Fed Week! The Fed meets on Wednesday for the second-to-last time this year for that all important rate cut decision! While it might sound exciting and suspenseful, the decision is all but certain as the markets are pricing in a 98.4% chance of a 0.25% rate cut.

Before we get too excited about what this means for mortgage rates, here’s the reality: it probably won’t make a huge difference. The market has already factored in this week’s cut and another one expected in December, so we likely won’t see a significant drop in rates right away. That could keep buyers on the sidelines, waiting for “even lower rates."

Key Takeaway: The Fed is expected to cut rates by 0.25% this week, with markets already pricing in another cut in December. Unfortunately, mortgage rates likely won’t drop much immediately since these moves are already baked into the market.

Mortgage Rates Dropping — A Blessing & a Curse!

Let’s be honest — no one gets more excited about falling mortgage rates than Nick and myself. Every time we see rates tick a little lower, it feels like Christmas morning with refinance gifts waiting under the tree. 🎁

But those falling rates can be a double-edged sword. Lower rates often bring more uncertainty for buyers, who are now facing a double whammy: a slower housing market and growing expectations that rates will keep dropping. The result? Many are choosing to “wait it out.”

Just this past week, we’ve heard comments like:

“I heard the Fed’s cutting rates two more times this year — I’ll wait until then.”

“Homes are sitting longer — I’m going to see if prices drop even further.”

It’s a good reminder that even positive news on rates can stall momentum when buyers expect the best is yet to come.

As professionals in this field, it's our job to help clients see the opportunity in front of them! We are in a softening market. If you are a buyer, now is the time to snag a deal and ask the seller to pay for those closing costs. If you are a seller, you better price aggressively to stay competitive. Price too high, and your listing could sit and lose momentum fast.

Key Takeaway: Falling mortgage rates are great news, but they’re also causing buyers to hesitate, waiting for even lower rates and better deals. In this softening market, buyers should act now while negotiating power is strong, and sellers need to price competitively to avoid losing momentum.

Chase To Accept Bitcoin and Ethereum as Collateral

Remember back in September 2017 when Jamie Dimon, CEO of JPMorgan Chase, called Bitcoin a "fraud" and warned it would "blow up"? He even said he’d fire any employee trading crypto, calling it "stupid."

Fast forward just eight short years, and now Dimon is announcing that JPMorgan will let institutional clients borrow against Bitcoin and Ethereum by early 2026. While this is for big institutions, not everyday buyers like you and me, it’s a clear sign that crypto-backed lending is going mainstream! Mark my words: in less than five years, crypto could become an accepted form of payment in real estate.

This could be huge for our industry. Buyers holding Bitcoin or Ethereum might soon use their digital assets as collateral, giving them new ways to finance purchases without selling their holdings. Blockchain-based systems could also speed up closings and make transactions more transparent.

The world of finance is changing right before our eyes, and it’s critical to stay informed. If you don’t keep up, you risk being surpassed by a new generation of agents — maybe with less real estate experience, but far more tech savvy. It's imperative that you don’t let the rapid evolution of finance and technology pass you by!

Key Takeaway: Crypto-backed lending is quickly becoming mainstream, with JPMorgan planning to let institutional clients borrow against Bitcoin and Ethereum by 2026. For real estate, this could open new financing options for buyers, speed up transactions, and signal a growing role for digital assets in property deals.

Bill Pulte and Trump’s Plan to Lower Mortgage Rates

There’s a new proposal floating around that could help push mortgage rates even lower — and it centers on Fannie Mae and Freddie Mac (the government-backed agencies behind most conventional loans). The idea is for them to buy up more mortgage-backed securities (basically bundles of home loans) to make up for the drop in private investor demand. In theory, this could tighten spreads and help bring 30-year mortgage rates closer to 5%, even though we’re already near three-year lows around 6%.

Now, don’t get me wrong — Nick and I are all in for lower rates. (Because let’s be honest, that puts more money in everyone’s pocket!) But we’d be lying if we didn’t think this plan was semi-reckless as we are playing with fire.

Here’s why:

Taxpayer risk: If the market turns south, taxpayers could end up footing the bill since Fannie and Freddie are currently government-backed.

Market distortion: Artificially forcing rates lower could drive prices back up and overheat the housing market. We all know how that played out in 2020 👀

Less private investment: The more the government steps in, the less incentive private investors have to participate — which isn’t great long term.

Short-term fix: This could help now, but it doesn’t solve the bigger issues of affordability and housing supply.

Risky behavior: Lenders might take bigger risks if they think the government will always step in to bail things out.

Lower rates sound great — and they are — but this plan could have some serious long-term consequences if the market doesn’t cooperate.

Key Takeaway: A new proposal could push mortgage rates closer to 5% by having Fannie Mae and Freddie Mac buy more mortgage-backed securities — but it comes with serious long-term risks. While lower rates sound great now, too much government intervention could distort the market, increase taxpayer exposure, and create instability down the road.

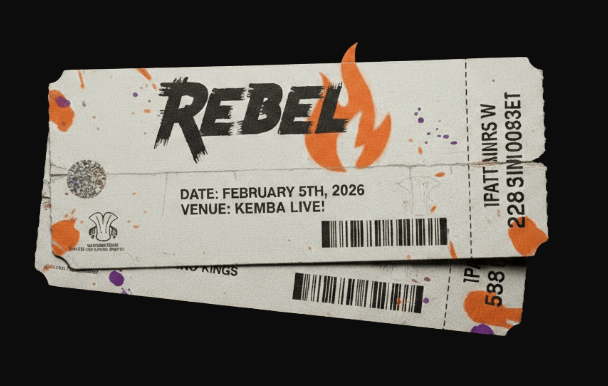

Rebel 2026 - Speakers Revealed & Tickets On Sale

The word is finally out! Speakers for our Rebel 2026 in early February have been released…and the lineup is nothing short of amazing. Central Ohio is getting world-class talent on the same stage.

We’ve got the world’s most talented emcee as the master of ceremonies, local talents who are making big waves across the country, branding experts who have helped some of the biggest in the industry shine online and the world’s leading expert on scaling.

And of course we have other surprises up our sleeve you won’t want to miss 💪

What is Rebel?

Rebel is a one-day event where professional misfits, marketers, and entrepreneurs come together to burn the old playbook and build something better. Raw. Loud. Unlike anything this industry has seen.

Mark Your Calendars 📅 The big event will be on Thursday February 5th, 2026

Get your tickets now…

Instagram Reels from the Week

Two Ways We Can Help

Let’s collaborate – schedule a zoom meeting

Tough deal? Let us help!

Don’t hesitate to reach out if you need anything at all. Have a wonderful week!