- Kreg & Nick - Weekly Mortgage Update

- Posts

- Trump Floats the Idea of a 50-year Mortgage

Trump Floats the Idea of a 50-year Mortgage

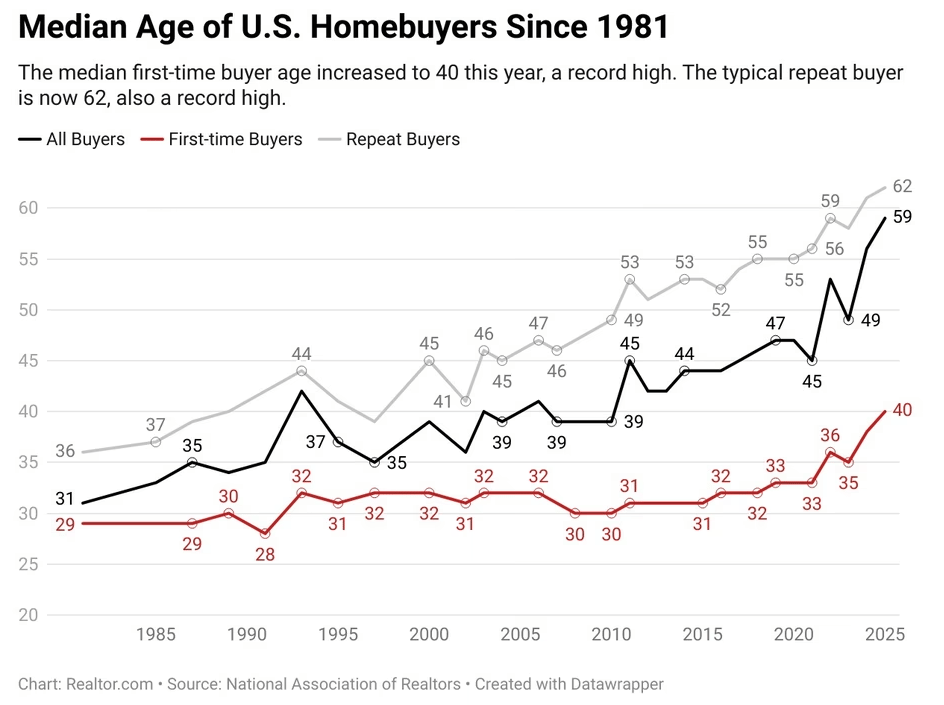

Home affordability has officially hit a breaking point — the median age of first-time homebuyers just jumped to 40, the highest in history. Washington is finally paying attention, with major proposals like Fannie Mae removing its 620 minimum credit score and even talk of a 50-year mortgage. But while these ideas grab headlines, the real issue remains clear: homes are simply too expensive, and middle-class Americans are feeling the squeeze.

What 👏A👏Week👏

We got 50-year mortgages, the removal of credit score requirements, stimmy checks, and even a potential end to the government shutdown! Weeks like this are exactly why we love putting together this newsletter. Let’s dive in!

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~5 minutes

Rates ended FLAT compared to last week, and volatility was MODERATE. Rates remain in the low 6% range for most loan types without paying discount points. Paying discount points can get you in the high 5's.

Affordability Crisis Takes Center Stage!

Median Age of First-Time Homebuyers:

1980: 28 years old

1990: 30 years old

2000: 31 years old

2010: 32 years old

2024: 38 years old

2025: 40 years old

Man, these numbers hit hard. When the National Association of Realtors® reported last year that the average first-time buyer was 38, I was stunned. Now, just one year later, that number has climbed to 40, the highest on record. First-time buyers make up only 21% of home purchases, the lowest share since 1981.

Nick and I feel this at our core, since we’ve always focused on helping first-time buyers. But with rising prices and higher mortgage rates, so many younger families are being priced out.

It is very clear that housing affordability has finally taken center stage in Washington. In the past few weeks, several new proposals have been introduced to tackle this crisis. Let’s break down what’s being discussed...

Fannie Mae Eliminates 620 Minimum Credit Score Requirement

If you’ve been around real estate for a hot second, you know the golden rule: Conventional loans required a minimum 620 credit score. That’s been the standard for as long as I’ve been in the business.

But that just changed. Fannie Mae (government entity backing Conventional loans) announced that it’s eliminating the 620 minimum credit score requirement. Instead of relying on that hard cutoff, Fannie Mae’s Desktop Underwriter (DU) system will now analyze each borrower’s full financial profile to determine eligibility.

Now, if you think this is going to open the mortgage flood gates, think again.

Every lender will still have to run a loan through the Conventional Automated System. The chances of getting an "Approve" through the Automated System with a 5% down payment and scores below 620 are going to be slim to none.

This change benefits buyers with 20%+ down and credit scores below 620. Previously limited to FHA loans with mandatory PMI, they can now qualify for Conventional financing without mortgage insurance. It’s a welcome update that offers more flexibility for asset-rich borrowers with lower scores.

Key Takeaway: By eliminating the 620 minimum credit score, Fannie Mae now allows borrowers with lower scores and larger down payments to qualify for Conventional loans without PMI. While this change won’t open the door for everyone, it provides a great opportunity for those ready to put significant cash down.

Trump Floats the Idea of a 50-year Mortgage

Over the weekend, social media lit up with talk about a proposed 50-year mortgage and opinions were all over the place!

Here’s the reality: the chances of this actually being approved are slim, and even if it were, no one would be required to take it! Yes, a 50-year loan would lower monthly payments, but it would also mean significantly more interest paid over time...not ideal for most borrowers. What it does highlight is the pressure policymakers are feeling to address the severe housing affordability crisis.

To put this all in perspective, let’s take a stroll back in time....Before President Franklin D. Roosevelt’s New Deal created the 30-year mortgage in the 1930s, the average loan term was just 5 to 10 years, often interest-only, with 40–50% down payments and a balloon payment at the end. Homeownership was largely reserved for the wealthy, and house prices stayed low because borrowing was limited. The creation of the the fully amortized 30-year mortgage in the 1930's opened the homeownership door for many middle-class Americans. This didn’t make homes cheaper...it simply allowed people to borrow more money over a longer period.

Taking a step back, it's hard not to wonder if we are facing a 1930s-style housing crisis. Is housing becoming a luxury that only the wealthy can afford? And is extending loan terms really the only solution we have for middle-class Americans to achieve the dream of owning a home?

At the end of the day, this will NOT solve our affordability problem. We don't need even more debt for longer. This is creating a larger hamster wheel in which more Americans will never be able to escape.

Longer loan terms are not the solution. We need lower house prices. Period.

Key Takeaway: The 50-year mortgage highlights the growing pressure to address housing affordability. However, longer loan terms are not a real solution. To make homeownership truly achievable for middle-class Americans, we need lower home prices, not more debt stretched over time.

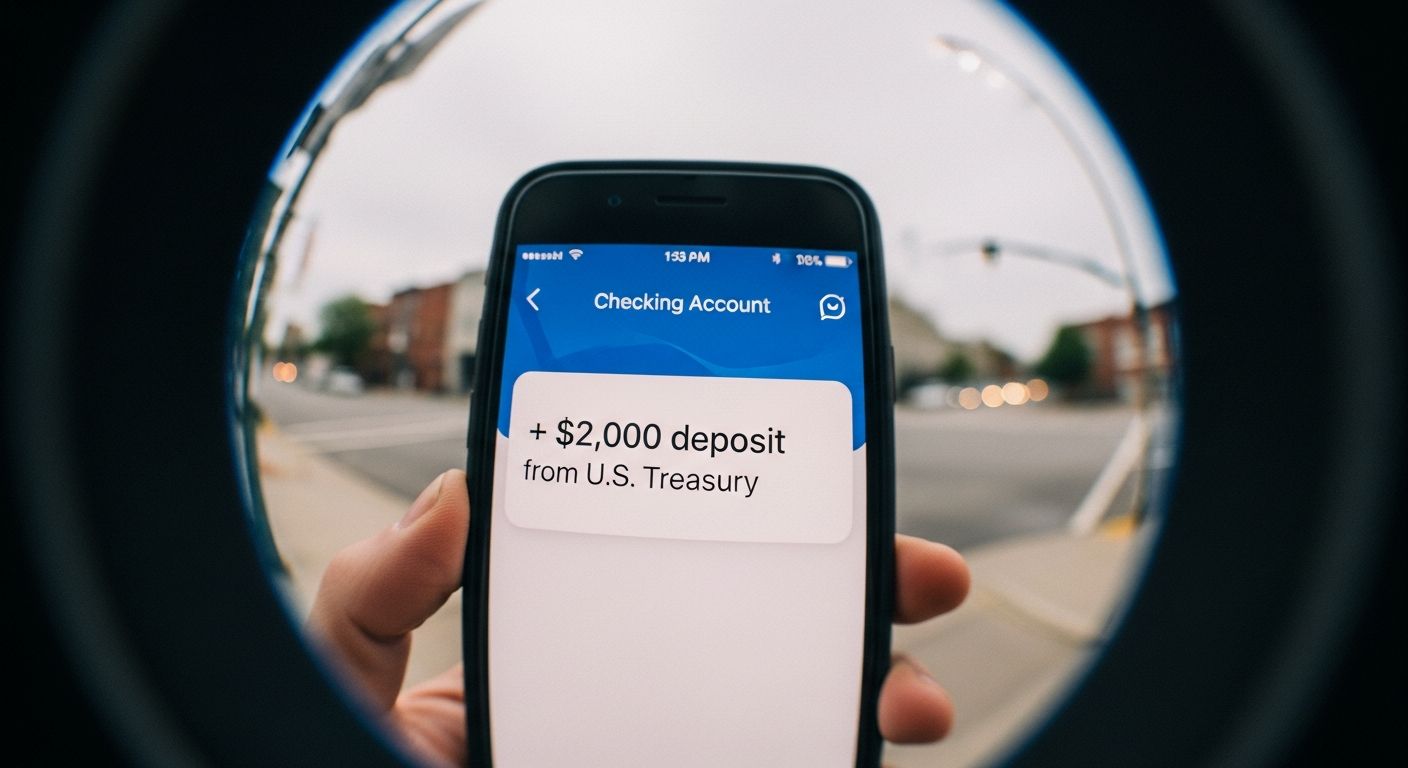

Stimulus Checks are Back?

President Trump recently announced the “tariff dividend”, a direct payment of at least $2,000 per American. The plan is expected to reach over 85% of U.S. adults, totaling more than $400 billion in payouts.

It’s easy to get excited about this injection of $$$...who wouldn’t enjoy seeing that money hit their account?! But while the short-term euphoria is real, it’s important to think about the long-term impact.

If the $2,000 stimmy checks fuel inflation or adds to national debt, we could see mortgage rates spike, making homeownership even more expensive. Historically, when inflation jumps, the Federal Reserve often steps in to increase rates to slow the economy.

So yes, the stimulus can provide immediate relief, but it’s worth remembering that today’s extra cash could come with tomorrow’s higher borrowing costs. Enjoy the short term pleasure, but plan wisely for the future.

Key Takeaway: The “tariff dividend” stimulus checks provide short-term financial relief, but they could contribute to inflation and higher mortgage rates over time. While the extra cash is sweet, it’s important to plan carefully, as today’s boost may lead to increased borrowing costs in the future.

Rebel 2026 - Speakers Revealed & Tickets On Sale

The word is finally out! Speakers for our Rebel 2026 in early February have been released…and the lineup is nothing short of amazing. Central Ohio is getting world-class talent on the same stage.

We’ve got the world’s most talented emcee as the master of ceremonies, local talents who are making big waves across the country, branding experts who have helped some of the biggest in the industry shine online and the world’s leading expert on scaling.

And of course we have other surprises up our sleeve you won’t want to miss 💪

What is Rebel?

Rebel is a one-day event where professional misfits, marketers, and entrepreneurs come together to burn the old playbook and build something better. Raw. Loud. Unlike anything this industry has seen.

Mark Your Calendars 📅 The big event will be on Thursday February 5th, 2026

Get your tickets now…

Two Ways We Can Help

Let’s collaborate – schedule a zoom meeting

Tough deal? Let us help!

Don’t hesitate to reach out if you need anything at all. Have a wonderful week!