- Kreg & Nick - Weekly Mortgage Update

- Posts

- Trump Picks New Fed Chair! So Mortgage Rates Dropped, Right?!

Trump Picks New Fed Chair! So Mortgage Rates Dropped, Right?!

Markets just got a reality check: Trump’s Fed Chair pick didn’t send rates lower—it pushed them higher, reminding us that expectations matter more than headlines. At the same time, gold and silver are flashing historic warning signs that investors are nervous about inflation, debt, and the long-term value of the dollar.

It's REBEL Week!

Unless you been living under a rock, you already know the biggest real estate and business conference kicks off this Thursday! With only a handful of tickets left, now's the time to secure your spot before they're gone! In the meantime, let's break down another crazy week in the mortgage world!

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~5 minutes

Rates ended FLAT compared to last week, and volatility was HIGH. Rates remain in the low 6% range for most loan types without paying discount points. Paying discount points can get you in the high 5's.

Trump Picks New Fed Chair! So Mortgage Rates Dropped, Right?!

This day has been a long time coming! Ever since President Trump returned to office in 2024, it was a foregone conclusion that Jerome Powell’s time as Fed Chair was limited. With Powell’s term set to expire on May 15, 2026, it was only a matter of time before Trump would appoint a new Chair more aligned with his aggressive rate-cutting goals!

That moment finally arrived on Friday, when Trump officially announced Kevin Warsh as his pick for the next Federal Reserve Chair! Woohoo!

So mortgage rates dropped after the announcement....right?!

Not so much....Stock market took a beating and mortgage rates actually worsened. 🫠

So, why would rates move higher when we finally got Trump’s Fed Chair pick?!

Here’s the simple answer and the central theme to investing in general: Markets don’t react to headlines...they react to expectations.

It’s not about who was chosen, it’s about what investors think that person will actually do.

And honestly, Warsh surprised a lot of people, Nick and I included.

Historically, Warsh has been known as a “hawk”, which in simplistic terms means he’s someone who believes inflation is the bigger enemy, even if that means keeping interest rates higher for longer. That’s completely different from Trump’s stance that rates should be much lower (he’s even floated numbers near 1%), which most economists say is not realistic right now.

When Warsh previously served at the Fed, he was very critical of the extremely low interest rates used during and after the 2008 - 2009 financial crisis. He warned that keeping rates too low for too long could eventually lead to inflation, which we all know ended up happening years later.

That track record matters to investors.

Granted, Warsh has more recently said he supports lower rates. However, the market clearly isn’t fully convinced yet. Until investors feel confident about how fast and how aggressively rates might come down, expect long-term interest rates to stay elevated for the near future.

Key Takeaway: This announcement doesn’t change the long-term outlook for rates, but it’s a good reminder that mortgage rates move on expectations, not political wins or headlines. Short-term volatility like this is very normal during major Fed transitions, and the picture usually becomes clearer once the dust has settled and policy direction is better defined.

Gold Is Screaming! Silver Is Shouting! Here’s What It Means for Real Estate

Over the last year, gold is up 72% and silver is up a whopping 162%! Moves like that are not normal and it usually means people are nervous about what lies ahead.

When investors rush into gold and silver, it’s often because they’re worried about things like inflation, global instability, or the value of the U.S. dollar losing strength. And honestly, that last part is the biggest concern for Nick and me.

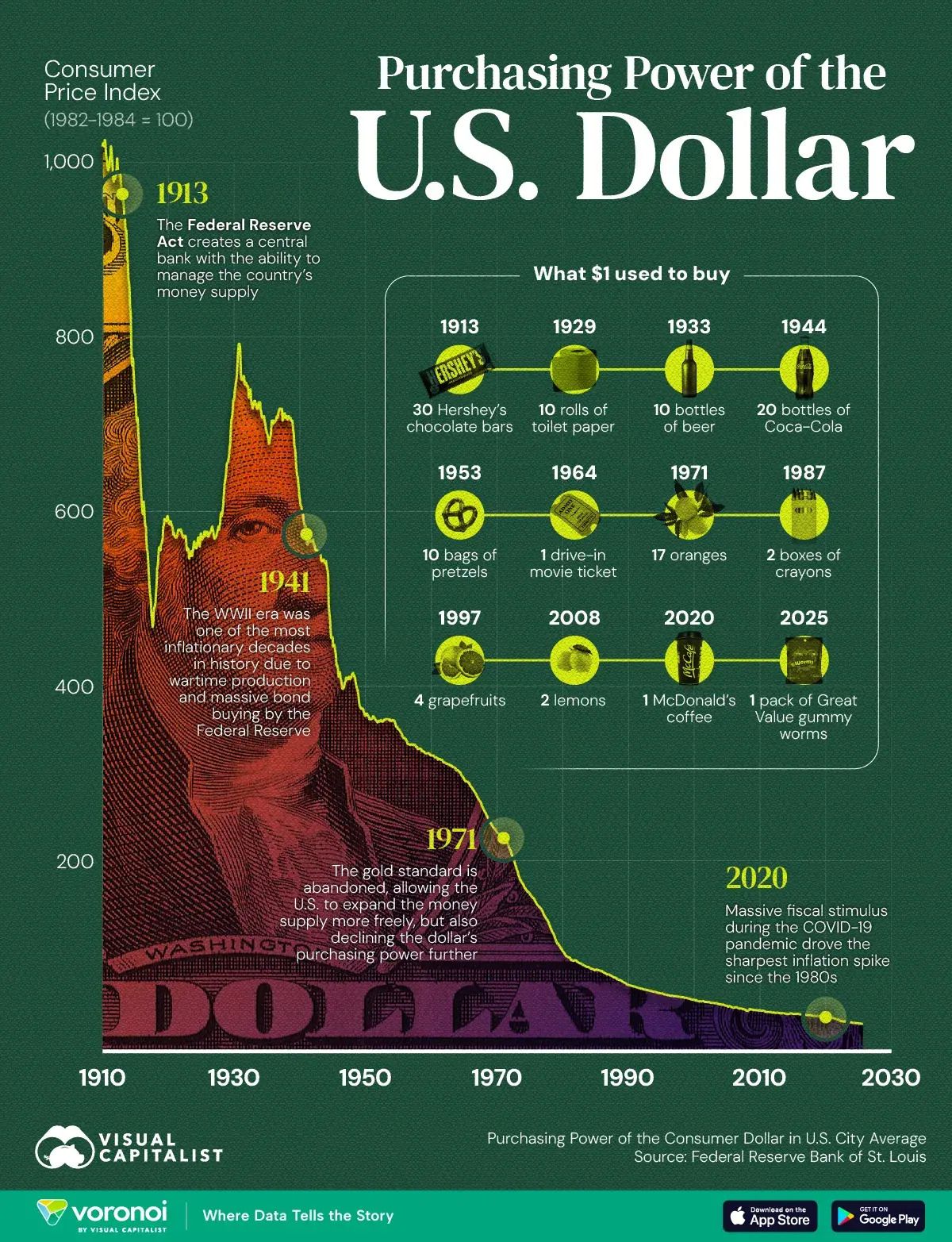

I recently saw a graphic that really put things into perspective. In 1913, one dollar could buy 30 Hershey’s chocolate bars! Today, that same dollar barely gets you a small pack of gummy worms at Discount Drugmart! It's a powerful example of the long-term impact of inflation. Your money simply doesn’t go as far anymore.

Right now, the U.S. is carrying roughly $39 trillion in debt, with no clear plan to slow it down. History shows that when this happens, the purchasing power of cash continues to erode and markets start sending warning signals.

Those warning signals are clearly here. And this is where real estate comes into play. When inflation rises, investors often move money into hard assets things with real, tangible value. That’s why spikes in precious metals often line up with higher home values. Real estate can act as a hedge, helping preserve purchasing power when stocks, bonds, or cash feel less predictable.

We may sound like a broken record, but this reinforces why real estate continues to be one of the most reliable long-term wealth builders. While real estate isn’t risk-free, it has historically been a powerful long-term hedge against inflation. As prices rise, real assets tend to rise as well. We need to continue to scream from the rooftops! If you aren't hedged, you're losing. And that’s a message worth continuing to share!

Key Takeaway: Surging gold and silver prices are flashing warning signs about inflation and the weakening purchasing power of cash. In environments like this, real estate has historically stood out as a strong long-term hedge, offering tangible value and protection as prices rise.

Rebel 2026 is Here.

After 11 months in the making - countless hours, meetings, sleepless nights, and more stress than we’d like to admit - it all comes together this Thursday. REBEL is set to become the biggest real estate conference the Midwest has ever seen!

Our speakers need no further introduction. The day will be packed with actionable insights, and yes, there’s a surprise celebrity guest joining us as well! This industry has changed, and the old playbook no longer applies. This isn’t the early 2000s anymore. It’s time to challenge the norm and do things differently.

Tickets are 95% sold out. If you’re in, grab your seat before they’re gone.

See you soon, rebel friends. 🔥

Mark Your Calendars 📅 The big event will be on Thursday February 5th, 2026

Instagram Reels of the Week

Two Ways We Can Help

Let’s collaborate – schedule a zoom meeting

Tough deal? Let us help!

Don’t hesitate to reach out if you need anything at all. Have a wonderful week!