- Kreg & Nick - Weekly Mortgage Update

- Archive

- Page 2

Archive

Foreclosures Are Rising ⬆️

Foreclosures are rising again, with Ohio now among the hardest-hit states. The Fed is being forced to make a major rate decision without new jobs or inflation data. And headline mortgage changes like 50-year and portable loans may be on pause amid a federal investigation.

First the 50-Year Mortgage...Now Assumable or Portable Mortgages 🥴

Assumable and portable mortgages sound helpful, but they could actually make affordability worse. NAR is now calling for a big rebound in 2026 with home sales jumping 14%. And after months of delays, this week’s jobs data could shake up the market fast.

Trump Floats the Idea of a 50-year Mortgage

Home affordability has officially hit a breaking point — the median age of first-time homebuyers just jumped to 40, the highest in history. Washington is finally paying attention, with major proposals like Fannie Mae removing its 620 minimum credit score and even talk of a 50-year mortgage. But while these ideas grab headlines, the real issue remains clear: homes are simply too expensive, and middle-class Americans are feeling the squeeze.

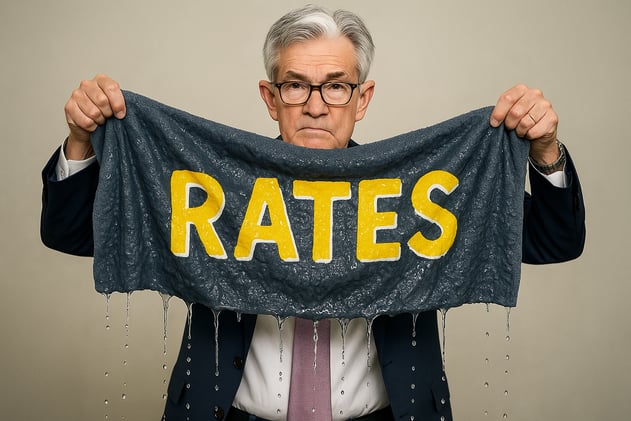

Fed Cuts and Mortgage Rates Spike Again 🤦♂️

The Fed cut rates, but Powell’s comments sent mortgage rates higher and dampened hopes for more cuts this year. A missing jobs report and rising layoffs hint at a cooling labor market. Meanwhile, home sales just hit a 30-year low — this housing market’s frozen solid.

Mortgage Rates Dropping — A Blessing & a Curse!

The Fed is set to cut rates again, but because the market already expects it, mortgage rates may not drop much—and buyers could keep waiting. At the same time, crypto is moving into mainstream finance, and JPMorgan’s plan to accept Bitcoin and Ethereum as collateral could reshape real estate. Now, a Trump-backed proposal to push rates even lower through Fannie and Freddie brings short-term relief, but with big long-term risks for the housing market.

Gold Stores Wealth. Real Estate Builds It.

Gold is at record highs and some investors are questioning whether it’s time to turn shiny profits into properties that actually build wealth. Meanwhile, Washington drama is heating up as the CFPB faces a potential shutdown—raising big questions for future homebuyers and lending rules. And just to keep the markets guessing, the latest CPI print is landing this Friday, adding even more uncertainty (and potential volatility) to the days ahead.

Tariff Wars Back - Rates Set to Plunge?! 🥊

Stocks tanked after Trump announced a 100% tariff on Chinese imports, sparking one of the biggest single-day rate improvements we’ve seen in weeks. 🏠📉 While mortgage rates dipped short-term, the long-term risk is inflation — which could reverse those gains fast. Meanwhile, the housing market is moving at its slowest pace since 2009, but that’s where tough agents sharpen their edge and seize new opportunities.

Property Tax Spike Hits New Build Buyers — Here’s How to Protect Yours.

Property taxes are back in the spotlight — and not in a good way. A new lawsuit and state-level proposals are exposing just how costly “underestimated” taxes can be for Ohio homeowners. Here’s what you need to know to protect yourself (and your clients) before the next bill hits.

What a Government Shutdown Could Mean for Rates & Closings ⚠️

A government shutdown is set to hit Tuesday, September 30th at 11:59 PM, and it could rattle housing in ways you don’t expect. Yet there’s a twist: history shows shutdowns can push mortgage rates lower as investors flee to safe assets. This week’s big jobs report on Friday is the next biggest indicator for where rates go next.

Powell Cuts Rates and Mortgage Rates Go Up...What?!

Powell cuts rates...but mortgage rates rise. What’s driving this upside-down market, and could 2025 repeat last year’s rate surge? Trump’s $100K visa fee is shaking up housing demand and wages—including right here in Central Ohio. Meanwhile, Nvidia is betting $5 billion on Intel’s Columbus-area mega-fab, setting the stage for more jobs, higher pay, and a tech boom in our backyard.

What Will Happen AFTER the Fed Cuts Rates?

Mortgage rates have dipped to their lowest level of 2025 as the Fed is poised to cut rates, creating a rare window for buyers and refinancers. But a rate cut doesn’t guarantee lower mortgage rates—last year’s similar cut led to a quick rebound when stronger economic data surfaced. With a weakening job market, slipping consumer confidence, and homes taking longer to sell, the next move for rates will depend on how the economic data unfolds.